OpenGradient Research

About OG Research

OpenGradient is recognized as a pioneer in DeAI. OpenGradient Research has a primary focus of advancing machine learning and AI research at the cutting edge of innovation. OpenGradient Research explores an extensive range of high-impact DeAI applications across diverse industries including the development, validation, and deployment of models for DeFi, general blockchain technologies, risk assessment, tokenomics, TradFi, portfolio agents, among other emerging and established domains.

A core objective of our research program is to address pressing real-world challenges through the design of scalable, secure, and transparent DeAI solutions that strengthen and enrich the broader AI and financial ecosystems. By conducting rigorous investigations and offering novel insights, OpenGradient seeks to advance the state of the art in DeAI and illuminate new pathways for transformative applications. Our team fulfills a crucial function by leveraging advanced computational and statistical methods to derive actionable insights from large-scale, decentralized data. Drawing upon theoretical frameworks in machine learning, engineering, finance, and other disciplines, we design and implement models that rigorously fulfill needs in the space.

Beyond technical model development, OG Research collaborates closely with various internal and external stakeholders. This multidisciplinary engagement ensures that machine learning solutions are not only rigorously validated but also aligned with delineated objectives and user needs. Our team contributes to the broader blockchain research community by disseminating their findings through publications and open-source initiatives. Consequently, OpenGradient Research serves as both a catalyst for technological innovation and a bridge between theoretical advances and real-world, decentralized applications.

We invite you to revisit this page frequently for ongoing updates on our current projects, recently developed models, and cutting-edge perspectives on the continually evolving landscape of DeAI. We look forward to sharing our latest breakthroughs and fostering greater understanding in this dynamic field.

Latest

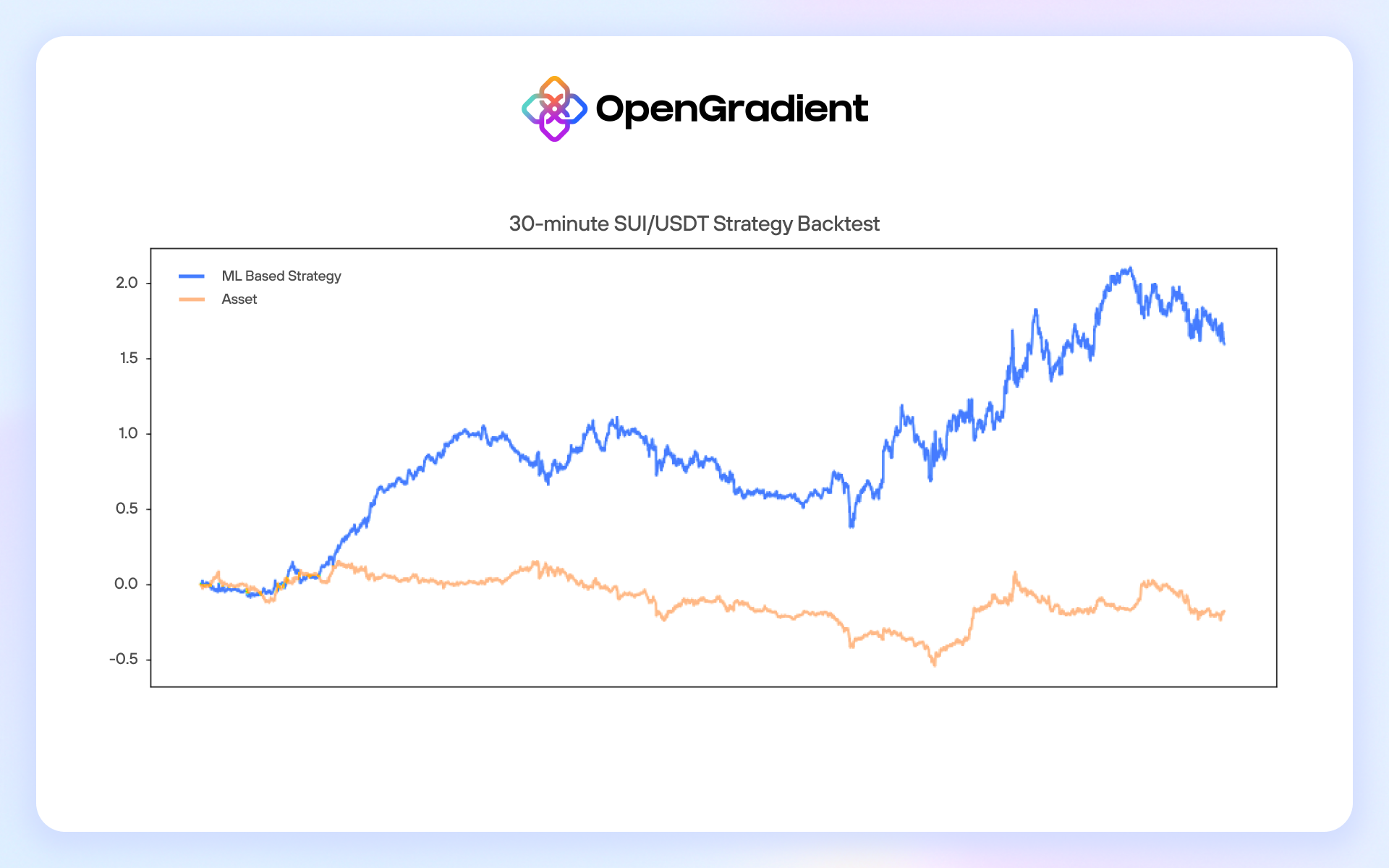

Spot Forecasting in DeFi (blog)

Spot forecasting is the attempt to predict future spot price movement over a given timeframe. Such forecasts can inform manual or algorithmic trading, enhance yield aggregators and vaults by dynamically adjusting risk exposure, and serve as inputs for Modern Portfolio Theory in DeFi. OpenGradient developed example 30-minute and 6-hour SUI/USDT forecasting models, each trained on recent OHLC candles and post-processed to predict returns with measurable accuracy. These methods have been backtested—albeit with the usual limitations—demonstrating their potential for improved cumulative returns. Platforms like DoubleUp are already integrating OpenGradient’s models to set AI-driven prediction market moneylines, illustrating how secure, verifiable ML workflows can strengthen a wide array of crypto applications.

Volatility Forecasting in DeFi (blog)

Volatility forecasting, though often overshadowed by spot price prediction, is indispensable to a maturing DeFi landscape where applications such as mean-variance optimization, lending protocols, dynamic AMM fees, and options pricing hinge on accurate measures of future risk. OpenGradient’s research underscores this importance by demonstrating enhanced forecasts—evidenced by correlations exceeding 0.8 for its one-hour ETH/USDT model—when leveraging machine learning rather than naive estimations. Such insights inform a broad spectrum of strategies, from portfolio rebalancing and hedging to parameter tuning in liquidity pools and collateral management. The fundamental approach involves translating OHLC data to log-prices for concise feature sets, then refining model outputs via Lasso optimization. By integrating predictive volatility into DeFi infrastructure, participants can better manage extreme market fluctuations, mitigate liquidation cascades, and design more resilient protocols. As DeFi continues to expand, sophisticated volatility forecasting capabilities will be crucial for sustaining innovation, stability, and the long-term reliability of decentralized financial ecosystems.

Recent Research

Mitigating Risk and Loss in AMM Liquidity Pools: A Dynamic Fee System based on Risk Prediction

In decentralized finance, constant function market makers have transformed asset trading by enabling automated market making. However, the nature of static trading fees in CFMM models raises concerns about the long-term profitability of liquidity providers because LPs are not compensated for increased risk during volatile environments. We introduce a dynamic fee system that leverages a simple machine-learned model to forecast volatility and adjust fees in real time based on market conditions. Historical simulations show that a predictive dynamic fee model generates higher total collected fees for LPs compared to static fee structures. By adjusting fees according to market volatility, the model compensates LPs for increased risk during volatile periods, thereby enhancing their profitability and the attractiveness of liquidity provision in DeFi ecosystems.

In our simulation we find over 15% increase in total LP fees collected in both WETH and WBTC stablecoin pools. This significant increase demonstrates the value of AI/ML in the DeFi ecosystem. Read the paper here. You can also access the ETH model itself in OpenGradient Hub.

Areas of Research

See our blog post on Real Verticals of Applied AI in Web3

Protocol Optimization

AI/ML-driven optimizations can dynamically tune parameters—such as trading fees, asset pricing curves, and liquidity parameters— DeFi protocols to improve user returns, stability, and operational efficiency. By analyzing large datasets, these models can forecast market volatility, protect liquidity providers from arbitrage, and mitigate impermanent loss. Beyond DeFi, intelligent workflows apply to areas such as dynamic gas pricing and graph-based recommendations in SocialFi, highlighting how data-driven optimizations enhance both technical performance and user experience in blockchain ecosystems.

Portfolio Management

Modern portfolio management relies on AI/ML models to evaluate risk and return across diverse assets, optimize allocations, and maximize risk-adjusted returns. Adapting these techniques to crypto involves forecasting spot prices, volatility, and market correlations, enabling automated construction of efficient-frontier portfolios for DeFi users. By integrating such models, protocols and dApps can systematically manage assets while improving transparency, making DeFi more accessible to both retail users and institutional investors.

Reputation Systems

AI/ML-based reputation mechanisms move beyond simple uptime metrics to incorporate on-chain and off-chain data—network performance, user feedback, and historical reliability. Deep neural networks and graph-based methods detect complex malicious behaviors and collusion across DePIN networks. Such intelligent, dynamic scoring fosters a more trustworthy ecosystem by cryptoeconomically incentivizing good node behavior and mitigating reliability risks.

Business Intelligence and Analytics

Statistical tools and machine learning algorithms enable data-driven decision-making by analyzing user behavior, on-chain transaction patterns, and contract interactions. In DeFi, real-time anomaly detection identifies potential market manipulation, and predictive modeling assesses the health of liquidity pools. By integrating verifiable analytics into smart contracts, developers can optimize features, enhance user experiences, and improve protocol security within a decentralized environment.

AI Agents

AI agents extend beyond simplistic rule-based bots by employing language models and agentic reasoning frameworks to adapt autonomously in real time. In Web3, these agents benefit from permissionless interaction with smart contracts and user wallets, streamlining automated financial operations, gameplay, and data analysis. Partnerships leveraging OpenGradient’s inference and reasoning infrastructure exemplify how agentic AI can orchestrate on-chain services, underscoring a new frontier for decentralized automation.

Risk Management

Robust risk management relies on ML-driven models capable of interpreting past data to mitigate credit, fraud, and systemic market vulnerabilities. By dynamically adjusting collateral requirements in lending protocols or identifying exploit threats, these models protect both users and platforms. Such approaches can make DeFi more appealing to institutional investors, showcasing how data-centric methodologies foster greater financial stability across decentralized networks.

Natural Language Interface

Natural language interfaces abstract away the complexities of blockchain, allowing users to execute transactions and manage assets through conversational commands. By merging large language models with smart contract automation, tasks like portfolio adjustments or NFT searches become more intuitive. Projects leveraging embeddings for on-chain indexing and semantic search further broaden the potential for personalized user journeys, facilitating widespread adoption of blockchain technology.

Prediction Markets

AI/ML enriches on-chain prediction markets by parsing historical data, sentiment indicators, and market flows to produce more accurate probability estimates. Additionally, “AI oracles” can serve as impartial dispute resolvers, minimizing the need for human-based voting and ensuring tamper-proof outcomes. By using forecasts for pricing and liquidity provisioning, novel platforms demonstrate how data-driven approaches can refine user experience in decentralized betting and speculation.

AI-Generated Content (AIGC)

AI models, such as diffusion networks and language models, enable the automated creation of digital art, text, and multimedia for blockchain projects, including NFT marketplaces. Decentralized compute networks further reduce inference costs by aggregating distributed GPU resources. OpenGradient’s decentralized infrastructure similarly underscores how decentralized filestores and blockchain-based access can ensure censorship-resistant AI services for content generation.

Security / Value Extraction (MEV)

MEV involves extracting value through transaction ordering, an area where AI can optimize sequencing strategies without undermining network integrity. Machine learning methods also detect front-running and other exploits, adjusting propagation to reduce malicious activities. Advanced frameworks, like particle swarm optimization and graph neural networks, offer rigorous vulnerability scanning and classification of suspicious contracts, making Web3 ecosystems safer and more resilient.

OpenGradient Models on OG Hub

This model dynamically adjusts trading fees in a WBTC/USDC AMM by forecasting market volatility on a one-minute horizon, using a log-log maximum absolute difference (LLMAD) metric. By updating fees in real time, the model compensates liquidity providers for heightened risk during volatile periods, thereby increasing total collected fees relative to static fee schedules. Implemented as a linear regression with Lasso-driven feature selection and trained on high- and low-price data from January to May 2024, the system determines fee levels in basis points, aiming for an average of 30bps. Simulation results confirm that frequent fee adjustments, informed by short-term volatility predictions, enhance overall profitability for liquidity providers while maintaining transparent and predictable conditions for traders.

This model uses one-minute predictions of ETH/USDT price volatility, quantified as the log-log maximum absolute difference (LLMAD), to dynamically adjust trading fees in an AMM context—thereby compensating liquidity providers for heightened risk during volatile periods. By replacing static fees with a data-driven approach, OpenGradient’s linear regression model (trained on January–May 2024 minutely high and low price data and refined via Lasso feature selection) addresses concerns regarding LP profitability in constant function market makers (CFMMs). Historical simulations confirm that these frequent volatility-based updates boost aggregate fees collected by LPs and enhance the overall appeal of liquidity provision in DeFi.

This one-hour volatility forecast model for ETH/USDT leverages 10 prior 30-minute candles (five hours) to predict the standard deviation of one-minute returns over the ensuing hour. By log-transforming the inputs and optimizing for mean squared error (MSE) against the future volatility target (

Yield Farming Optimization Demo

A deep learning model for optimizing yield farming strategies across multiple tokens. Built with PyTorch this model demonstrates the viability of ML in yield optimization to act as a decision support tool for yield farmers, helping them evaluate opportunities across different pools and market conditions while considering multiple risk factors.

SUI/USDT 30-min Return Forecast

This model predicts the 30-minute return of the SUI/USDT pair by transforming 10 successive 30-minute OHLC candles into log-price form, then processing them through a single-layer weighted model optimized by Lasso. By using log-prices (rather than explicitly enumerating percentage-based features), the model exploits linear combinations that approximate percent changes without proliferating highly correlated input variables. Post-processing through arctanh and inverse

SUI/USDT 6-hour Return Forecast

This model predicts the 6-hour return of the SUI/USDT pair by transforming 6 successive 3-hour OHLC candles into log-price form, then processing them through a single-layer weighted model optimized by Lasso. By using log-prices (rather than explicitly enumerating percentage-based features), the model exploits linear combinations that approximate percent changes without proliferating highly correlated input variables. Post-processing through arctanh and inverse

Partnering with Us

OpenGradient stands at the forefront of decentralized AI, combining rigorous theoretical research with hands-on model development to advance the state of machine learning in blockchain and beyond. By systematically exploring applications such as DeFi optimization, portfolio management, risk assessment, tokenomics, and AI-driven agents, our team delivers sophisticated solutions that address real-world challenges. Whether it involves fine-tuning ML models to enhance transactional throughput, leveraging neural networks for network security, or conducting anomaly detection to mitigate exploit risks, we strive to produce data-driven systems that bring tangible benefits to decentralized ecosystems.