AlphaSense

AlphaSense is a new tool pioneered by OpenGradient that allows developers to wrap verifiable AI workflows that can empower AI agents and applications with powerful signals. TLDR: Give your AI agent superpowers, read our case study on a live implementation.

Examples:

- Volatility AlphaSense - Generates a constant feed of volatility forecasts for assets powered by ML models, can be leveraged by portfolio managers (or agents) to de-risk portfolio, AMMs to scale trading fees, or lending protocols to adjust their LTV ratio.

- PriceForecast AlphaSense - Creates a constant feed of spot returns forecast for assets powered by time-series models, can be leveraged by yield strategies to improve risk-adjusted returns.

- Sybil AlphaSense - Takes in a series of wallet addresses and outputs within a confidence interval which wallet addresses are likely to be Sybil accounts given past transaction history.

- Markowitz AlphaSense - Takes in historical price series for assets and generates optimal portfolio goal positions using MPT-style mean-variance optimization.

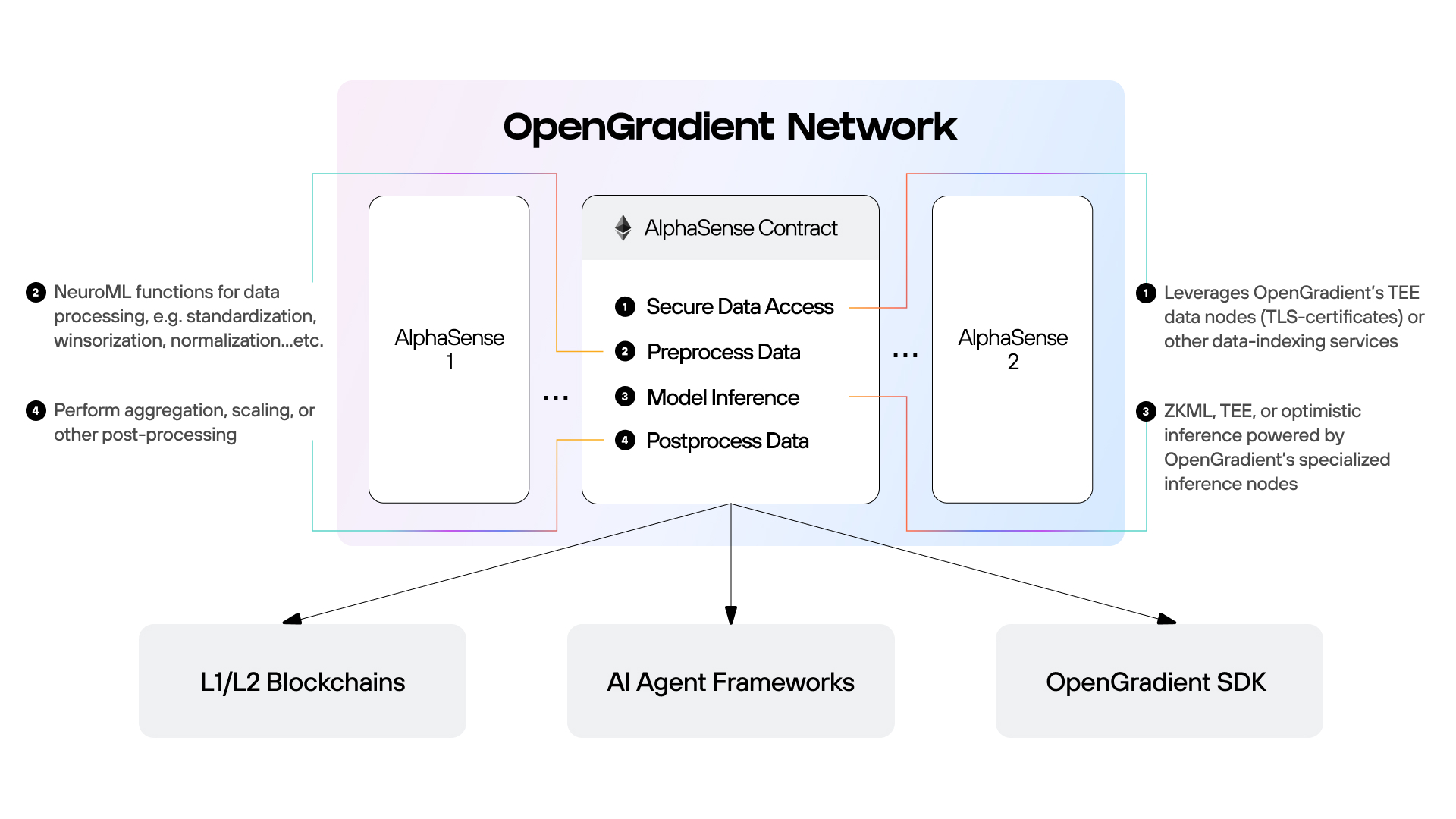

By leveraging (or developing customized) models on the AI Model Hub, SolidML, and OpenGradient’s infrastructure, developers can create powerful and secure AI workflows. These automated AI workflows can be wrapped into LLM tools used for AI agent toolcalls, and can also be accessed directly on-chain by other smart contracts or by traditional software applications through our python SDK.

Value Proposition:

- Agents can tap into AlphaSense to perform much more difficult actions and complex tasks, like leveraging risk forecasting streams to shield portfolios from drawdowns and volatility.

- Applications on different chains can use AlphaSense to optimize their protocols or develop intelligent features.

- Developers building applications with our SDK can tap into AlphaSense to empower their AI application by leveraging our verifiable workflows